It can be real (e.g. a bill that needs to be paid) or potential (e.g. a possible lawsuit). Liabilities refer to things that you owe or have borrowed; assets are things that you own or are owed. Your transactions on this website are fully secure & encrypted through Intuit’s Payment Gateway.

- However, for some accounts in business view, you’ll have a different way of selecting account types and detail types when you’re creating a new account.

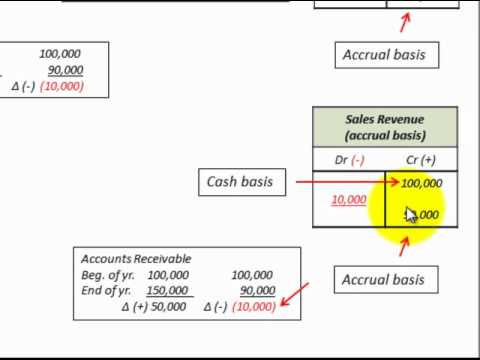

- If the debit is larger than the credit, the resultant difference is a debit, and this is listed as a numerical figure.

- Because these materials are not immediately placed into production, the company’s accountants record a credit entry to accounts payable and a debit entry to inventory, an asset account, for $10 million.

- All QuickBooks Online accounts use both account types and detail types in the chart of accounts.

Liability accounts are divided into ‘current liabilities’ and ‘long-term liabilities’. A debit to a liability account means the business doesn’t owe so much (i.e. reduces the liability), and a credit to a liability account means the business owes more (i.e. increases the liability). Each lease you create has a specified payment

frequency, most commonly monthly, quarterly, semi-annual, or annual. Normally, the Calculate Lease Expenses process accounts for interest

on lease liability or operating lease expense on each interest due

date on the amortization schedule. The main difference between assets and liabilities is that one adds to a company’s net worth while the other deducts from it. For example, the inventory a company owns—but expects to sell within the current fiscal year—would be considered a current asset.

Even in the case of bankruptcy, creditors have the first claim on assets. This can either be raised through equity (Issuance of shares on the stock exchange) or debt (Obtained from banks or issuance of bonds). A provision is a liability or reduction in the value of an asset that an entity elects to recognize now, before it has exact information about the amount involved. For example, an entity routinely records provisions for bad debts, sales allowances, and inventory obsolescence. Less common provisions are for severance payments, asset impairments, and reorganization costs.

Relax about tax

A constructive obligation is an obligation that is implied by a set of circumstances in a particular situation, as opposed to a contractually based obligation. The primary classification of liabilities is according to their due date. The classification is critical to the company’s management of its financial obligations. Current liabilities, also known as short-term liabilities, are financial responsibilities that the company expects to pay back within a year. An asset is anything a company owns of financial value, such as revenue (which is recorded under accounts receivable).

- The natural balance of a liability account is a credit, so any entries that increase the balance of a liability account appear on the right side of the journal entry.

- The Small Business Administration has a guide to help you figure out if you need to collect sales tax, what to do if you’re an online business and how to get a sales tax permit.

- The current month’s utility bill is usually due the following month.

- When cash is deposited in a bank, the bank is said to “debit” its cash account, on the asset side, and “credit” its deposits account, on the liabilities side.

All QuickBooks Online accounts use both account types and detail types in the chart of accounts. However, for some accounts in business view, you’ll have a different way of selecting account types and detail types when you’re creating a new account. Finally, you’ll see a second list of options for where to put the new category (this selects the detail type). Also, for these accounts in business view, you can only create new subaccounts under existing parent accounts. If, for some reason, you need to create a new parent account, you can by switching to accountant view. When you create a new account in the chart of accounts, select the account type first from the list that QuickBooks populates for you.

Non-Current Liabilities

Liabilities are a vital aspect of a company because they are used to finance operations and pay for large expansions. They can also make transactions between businesses more efficient. For example, in most cases, if a wine supplier sells a case of wine to a restaurant, it does not demand payment when it delivers the goods. Rather, it invoices the restaurant for the purchase to streamline the drop-off and make paying easier for the restaurant. While Assets, Liabilities and Equity are types of accounts, debits and credits are the increases and decreases made to the various accounts whenever a financial transaction occurs. ANSWER – Because the bank statement is stated from the bank’s point of view.

Examples of liabilities are accounts payable, accrued expenses, wages payable, and taxes payable. These obligations are eventually settled through the transfer of cash or other assets to the other party. Current liabilities are typically settled using current assets, which are assets that are used up within one year. Current assets include cash or accounts receivable, which is money owed by customers for sales.

How Do I Know If Something Is a Liability?

Simply put, a business should have enough assets (items of financial value) to pay off its debt. Business loans or mortgages for buying business real estate are also liabilities. All businesses have liabilities, except those that operate solely with cash. To operate on a cash-only basis, you’d need to both pay with and accept cash—either physical cash or through your business checking account.

How Are Assets and Liabilities Ordered on a Balance Sheet?

Current liabilities can also be settled by creating a new current liability, such as a new short-term debt obligation. There are also a small number of contra liability accounts that are paired with and offset regular liability accounts. One of the few examples of a contra liability account is the discount on bonds payable product archives (or notes payable) account. Considering the name, it’s quite obvious that any liability that is not near-term falls under non-current liabilities, expected to be paid in 12 months or more. Referring again to the AT&T example, there are more items than your garden variety company that may list one or two items.

A Guide to Assets and Liabilities

Companies try to match payment dates so that their accounts receivable are collected before the accounts payable are due to suppliers. Like most assets, liabilities are carried at cost, not market value, and under generally accepted accounting principle (GAAP) rules can be listed in order of preference as long as they are categorized. The AT&T example has a relatively high debt level under current liabilities.

Examples of contingent liabilities are the outcome of a lawsuit, a government investigation, or the threat of expropriation. AT&T clearly defines its bank debt that is maturing in less than one year under current liabilities. For a company this size, this is often used as operating capital for day-to-day operations rather than funding larger items, which would be better suited using long-term debt. Accrued Expenses – Since accounting periods rarely fall directly after an expense period, companies often incur expenses but don’t pay them until the next period. The current month’s utility bill is usually due the following month. Once the utilities are used, the company owes the utility company.

Liabilities are also categorized, just as assets are, according to the time period when the debts are to be paid. Current liabilities refer to debts owed by the business that should be paid within the current fiscal year. Noncurrent or long-term liabilities are not yet due within the current fiscal period. Assets and liabilities are terms frequently used in business to state the property owned and the debts incurred, respectively.

Some examples of liabilities include expenses such as loans, payroll, and accounts payable. For example, a large car manufacturer receives a shipment of exhaust systems from its vendors, to whom it must pay $10 million within the next 90 days. Because these materials are not immediately placed into production, the company’s accountants record a credit entry to accounts payable and a debit entry to inventory, an asset account, for $10 million. When the company pays its balance due to suppliers, it debits accounts payable and credits cash for $10 million. A balance sheet is a financial tool used in business to determine a company’s assets and liabilities at a specific point in time (for instance, Dec. 1 of the calendar year). It is a snapshot of the company’s financial situation at the date of the statement.

The ratio of current assets to current liabilities is important in determining a company’s ongoing ability to pay its debts as they are due. Current liabilities are a company’s short-term financial obligations that are due within one year or within a normal operating cycle. An operating cycle, also referred to as the cash conversion cycle, is the time it takes a company to purchase inventory and convert it to cash from sales. An example of a current liability is money owed to suppliers in the form of accounts payable. Analysts and creditors often use the current ratio, which measures a company’s ability to pay its short-term financial debts or obligations. The ratio, which is calculated by dividing current assets by current liabilities, shows how well a company manages its balance sheet to pay off its short-term debts and payables.

It shows investors and analysts whether a company has enough current assets on its balance sheet to satisfy or pay off its current debt and other payables. The current ratio measures a company’s ability to pay its short-term financial debts or obligations. It shows investors and analysts whether a company has enough current assets on its balance sheet to satisfy or pay off its current debt and other payables. A liability is an obligation of a company that results in the company’s future sacrifices of economic benefits to other entities or businesses.

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets. Liabilities refer to short-term and long-term obligations of a company. Liability may also refer to the legal liability of a business or individual. For example, many businesses take out liability insurance in case a customer or employee sues them for negligence. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.