Best Travel Agency Software 2023 Reviews & Pricing

Kapture also enables travelers to securely and easily store their passport tickets and visa documents. This way, you can be assured that all your documents are in one place and easily accessible when needed. The best thing about this tool is that it uses artificial intelligence to generate content for you—which means it’s always up-to-date, always on brand, and never repeats itself. And since AI constantly learns, it will create even better content over time.

Finally, marketing software can be useful for agencies that want to promote their business online. These programs can help agencies create and manage their online presence, which can be a valuable tool in attracting new customers. If you’re a travel agent, you know that there are a lot of software applications to choose from. Some are free, while others are not.If you’re looking for free travel agency software, there are a few options to consider. Features include multilingual support, social media integration, SSL protection, and a Channel Manager to connect with online travel agencies. Pricing is monthly, and support is provided through online forums and phone assistance.

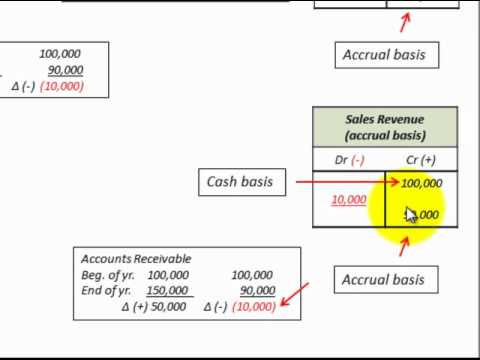

How does accounts payable software work?

This includes the name of your business, the address, and the contact information. No matter which software you choose, make sure that it meets the specific needs of your business. You also get Live Chat, SMS marketing, and an in-app calendar for quick and effective engagement with thousands of customers. That’s why travel CRM systems are equipped with tools to capture leads, nurture them, prioritize them with tags and scores, and collect vital information across various touchpoints. When it comes to managing customer experiences, one size doesn’t fit all.

- CRM can also help businesses profile their customers, including their travel preferences and spending habits.

- With almost 75% of bookings done online and a dynamic & ever-evolving travel market, it has become really essential to have a robust, simple & mature back-office solution that makes day-to-day actions coherent.

- The ease of use and user interface of the accounting software you’re considering.

- Zoho likewise helps you simplify passengers’ handling and classify them based on role.

- They prefer platforms that allow for multiple users, let them track billable hours and offers superior customer support.

Plus, it integrates with other popular business applications like Zoho CRM, so you can streamline your entire financial process. Reputable bookkeeping service providers understand the unique requirements and diverse scales of tourism agencies, ensuring tailored offerings that cater to their specific needs. Whether you are a small tour operator aiming for growth or a large travel management company handling multiple operations, these service providers adeptly adapt to your business demands. With a keen focus on efficiency, they provide comprehensive solutions, including meticulous financial record-keeping, budget management, expense tracking, and accurate financial reporting.

Award-Winning Customer Support

You’ll never be scrambling again to remember how many hours you worked for what client. Then add team members so you can see overall billable hours per client. With Tourwriter, you can easily create custom itineraries for your website visitors, making it easy for them to book travel arrangements and get the most out of their trip. TravelWorks is a software program that makes things easier for Travel Agents and Accounting Managers. TravelWorks simplifies commission management by organizing it all in one place – even when agents share commissions.

- Business accounting involves a wide range of activities in order to capture a business’s entire financial picture.

- It offers similar features to QuickBooks Online but with a more user-friendly interface.

- Although several providers on this list offer live customer support, Tipalti stands out for its multichannel customer support.

- With FreshBooks, you’ll know exactly where your business stands and whether you’re ready to take that next step in your business.

- Do it on-the-go with this easy-to-use mobile compatible accounting software that tour operators can take advantage of.

To streamline your selection process, it’s crucial to understand the key features that an ideal accounting software should possess, specially tailored to the needs of the travel industry. Accounting software for travel agencies is often tailored to the specific needs of the industry. For instance, a key requirement for many agencies is the ability to handle transactions in multiple currencies, given the global nature of their operations.

#8. Zoho CRM

Omnichannel marketing lets you interact with your customers across all the channels and have meaningful, contextual conversations with them. Since customers are bound to be different, ActiveCampaign’s segmentation lets you segregate your customers based on various factors. travel agency accounting In addition, you get machine learning, too – split automation, predictive sending, and conditional content employs machine learning for advanced results. With this solution, you can connect to other products, too, like FreshCaller and FreshDesk, which enhances its value.

Amadeus Travel Agent Desktop is software that helps travel agents and agencies book flights, hotels, and car rentals. It also provides various other features like fare comparisons, seat maps, and itinerary management. Xero is cloud-based accounting software that offers a variety of features and interfaces for users. This feature helps agencies manage various combinations of reservations customers may choose and offer accurate quotes on-the-fly. It also allows agents to present multiple options for similar packages based on pricing and inventory of the hotels, airlines or activity suppliers.

This allows travel agencies to respond more quickly to financial queries, make timely decisions, and improve their overall business responsiveness. TechnoHeaven stands as a leading Travel Portal Development Company, providing comprehensive Travel Portal Solutions. These solutions cater to a broad spectrum of clients, including travel agencies, tour operators, travel agents, Travel Management Companies (TMCs), Destination Management Companies (DMCs), and hotel chains.